Indicators

Generate Persistent Alpha

through Smarter Risk Management

VALDX: a set of patented sentiment and fundamental indicators

for asset managers to design persistent alpha-generating strategies.

Price Sentiment Analysis

Most sentiment analyses try to measure how people “feel” by analyzing what they “say” and use that as a proxy for what people will “do” regarding investment decisions. We all know that what people “feel”, “say”, and “do” are not always aligned. This is especially true in competitive marketplaces.

We believe that the best measure of investors’ sentiment is the price they are willing to pay for a stock. Implicit in the price that investors pay for a stock on any given day is a forecast of a company’s future operating performance (earnings). Valspresso was granted U.S patent 7,966,241 for this method of measuring price sentiment. Read more

Deep Fundamental Analysis

To provide context and veracity for the use of Sentiment, Valspresso’s Automated Stock Analyst performs deep financial analysis of publicly traded U.S. companies. This context is important to manage your strategy’s risk. Let’s say that one of your strategy’s holdings is a stock with a high expected earnings growth. If that company’s financial quality is poor, it is less likely to achieve or sustain that growth and therefore should be considered riskier. In that case, additional risk mitigation measures would need to be employed to achieve investment objectives. Read more

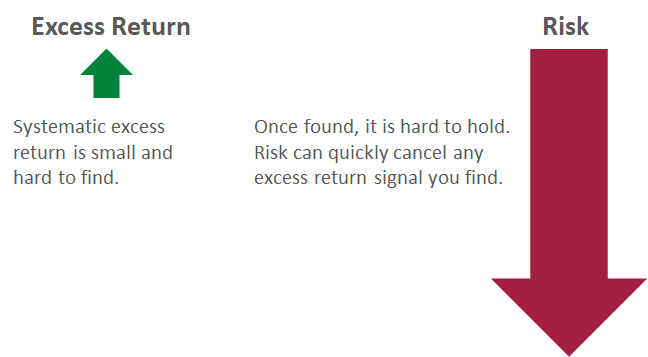

Capturing Excess Return is Hard

The stock market is a noisy and often volatile environment which results in substantial risk for trading strategies. Active trading strategies seek to find and capture excess return; however, systematic excess return is small and hard to find. Once found, it is hard to hold. Market risk can quickly cancel any excess return signal you may find.

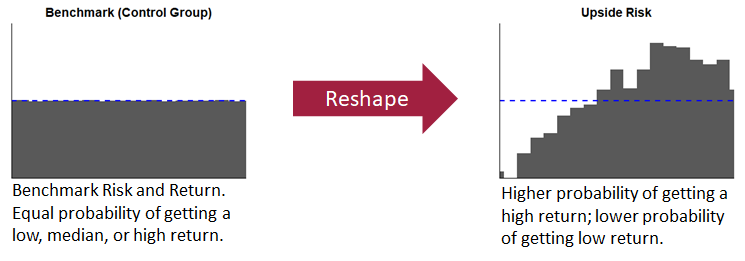

Risk-First Approach

Valspresso’s Indicators are used to predict and capture excess return by reshaping risk to our advantage. We start by understanding the drivers of risk and develop patented sentiment and fundamental indicators that reshape risk in such a way that allows us to then harvest excess return opportunities with a higher probability of success.

Predictive Power

The reshaping of risk to capture excess return has been demonstrated through backtesting and live trading strategies. Strategies have delivered an average annualized Alpha of approximately 8% with a range of 3% to 15%.

Over the short-run, we have demonstrated the predictive power of our indicators by analyzing the probability of outperforming the components of S&P 500. Over a 20 trading day time horizon (about one calendar month), the indicators demonstrate strong predictive power across various market conditions. Our methodology and research can be found in our technical white paper.

Build Your Own Strategies

Valspresso’s indicators empower subscribers to design and deploy persistent alpha-generating strategies. These indicators are particularly effective for fundamental managers, who need a starting point when analyzing multiple securities. Historical values are available from 2004 to present, along with back-tested example use-cases that clearly demonstrate the value of Valspresso data: deliver higher alpha and lower beta, consistently.

Cost Effective

Valspresso indicators are cost-effective for pension funds and other asset owners who may be looking to in-source their active equity investment function but have limited capacity to hire a team of analysts.

Empowering Investment Teams

Valspresso’s indicators empower investment teams to design persistent alpha-generating strategies. Our patented method provides meaningful, actionable insights into a stock’s current price. One such insight is the objective measurement of the market’s expectation for future earnings growth. Valspresso provides sentiment analysis as a daily data feed bundled with our complimentary indicators for earnings momentum and deep fundamental analysis. Our technology analyzes all companies on the U.S. major exchanges on a daily basis and delivers results before market open at 9:30 am. Historical values are available from 2004 to present along with back tested results for example strategies using our indicators.